Banking Outsourcing Services

In the 15 years of continuous support and strategic business partnership, Euroanswer has provided first-line technical support calls and ticketing for the internal end users for a global leader in the banking industry in Eastern Europe.

Our client desired a long-term strategic staffing partner they could trust to adapt themselves to the client’s needs, offering intelligent and efficient solutions with a problem-solving orientation, clarity, and professionalism.

We approached this partnership, understanding that the future belongs to intelligent business operations and customer experience. Our service desk support model proved to harness change and became adaptable to better fuel the business strategy, driving sustainable value and profitable growth.

Our expertise in Banking Business Process Outsourcing (BPO) offers unparalleled service in loan processing, transaction management, and cardholder support for consumer and commercial products. We don’t just process; we enhance productivity and efficiency, ensuring secure and compliant solutions tailored to the banking sector’s needs.

Trust is the cornerstone of outsourcing, especially in private banking. Euroanswer has years of experience as a trusted outsourcing ally for private banks. Our BPO solutions are bespoke, catering specifically to the requirements of the private banking sector.

The heart of our successful BPO company is our expert workforce, which emphasises efficient process execution and level 1 support, fostering high automation levels while meticulously handling anomalies and unique cases, thus ensuring the high service quality you anticipate.

Impact on Banking Operations

Guarantee Business Continuity: Transition to agile, global banking operations, releasing resources for more strategic initiatives.

Cost Reduction: Achieve up to a 40% reduction in operational expenses.

Enhance Customer Acquisition: Boost customer acquisition rates by up to 40%.

At Euroanswer We Are Delivering Robust, Quality Services

- Attain over 99.5% compliance in retail lending

- Mitigate operational risks and ensure boundary compliance

- Enhance compliance quality standards

Cultivate Innovation:

Expand Vision: Merge intelligent technologies with skilled banking talent to enhance the bank’s scope.

Optimise Decision-Making: Utilise resources efficiently for improved decision-making processes.

Elevate Customer Experiences: Transition to a fully digital model to enhance customer satisfaction and experience.

Workforce Optimisation: Focus on developing employee skills to adapt to innovative work methodologies and creative thinking.

At Euroanswer, we are dedicated to elevating your outsourced banking operations through our comprehensive BPO services, ensuring exceptional customer experiences and efficient level 1 support and service desk support. Our approach is not just about staffing; it’s about building a partnership that drives your business forward.

Enhancing Your Business with Banking BPO

The fundamental rationale for choosing to outsource banking customer support services aligns with the general objectives of outsourcing any business process. However, banking BPO offers unique advantages, particularly its adherence to legal and regulatory standards.

This brings a dual benefit to your business:

Firstly, it ensures that your banking services are managed with your business goals as a priority rather than solely focusing on the interests of the banks.

Secondly, the cost savings are twofold – not only in efficiently handling banking processes but also in avoiding financial or reputational damage that could arise from non-compliance with legal requirements.

By entrusting these tasks to experts, you minimise errors and inefficiencies, enhancing performance and effectiveness in your business operations.

If you want to know more about our services, do not hesitate to contact us!

Untangling value through our team of tech-savvy multicultural experts

In Romania

From 3 supporting locations:

Macedonia – Skopje, Romania – Bucharest and Galati

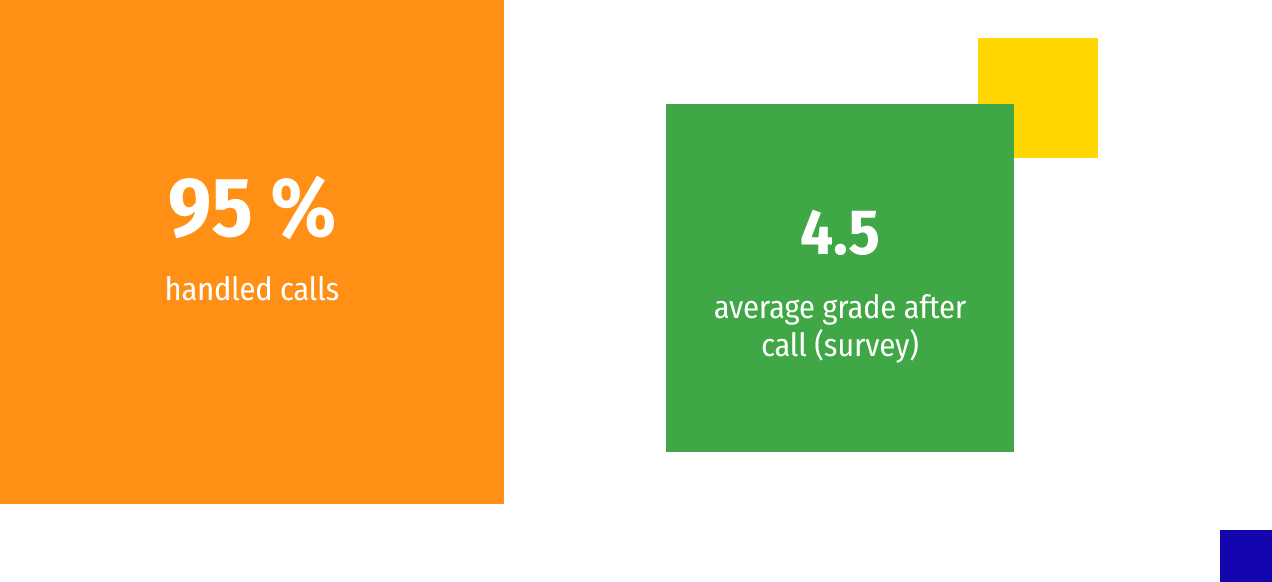

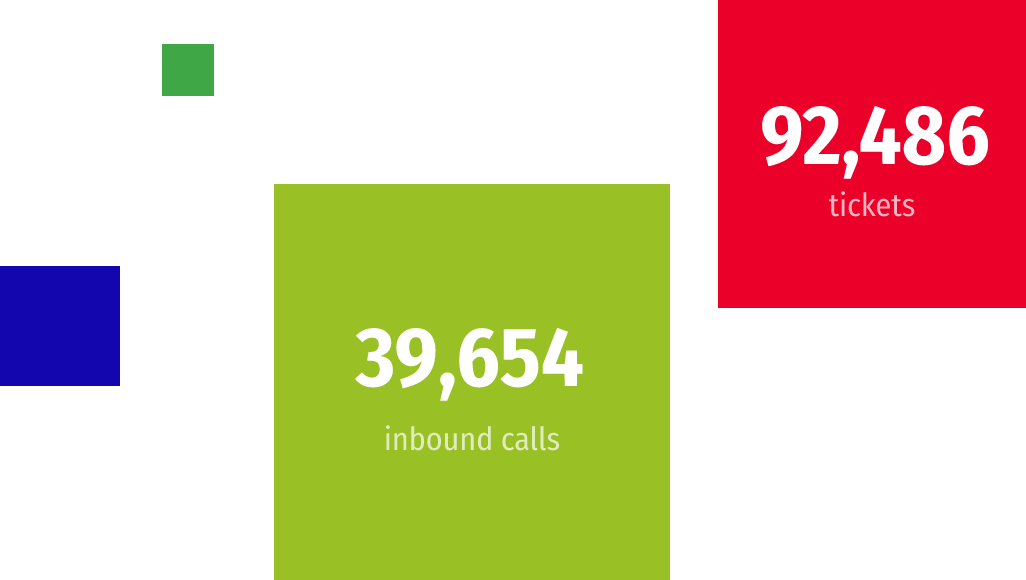

Contractual KPIs

Interactions (per year):

Second largest team on call:

Frequently Asked Questions

What are the primary benefits of partnering with Euroanswer?

1. It offers significant cost savings, not just in the efficient management of banking processes but also in avoiding potential financial or reputational damage due to non-compliance with legal standards.

2. Our expertise minimises errors and boosts performance and efficiency in your business operations.

We contribute to banking operations by guaranteeing business continuity through agile, global banking operations, reducing operational expenses. Our approach integrates intelligent technologies with skilled banking talent, focusing on efficient decision-making processes and elevating customer experiences. We also strongly emphasise workforce optimisation by developing employee skills for innovative work methodologies.

Choosing Euroanswer for banking BPO services offers several benefits:

1. It ensures services are managed with a focus on business goals.

2. It provides cost savings by efficiently handling processes. Our approach minimises errors and inefficiencies, enhancing business operations’ performance and effectiveness.

3. Our services are bespoke, catering specifically to the private banking sector with a high level of trust and compliance.